Introduction

With the advent of blockchain technology since 2009, the market has seen the increasing adoption of the tokenised economy, including the creation of various forms of tokenised assets.

One of these categories is what is known as Security Token Offering, or STO, in short.

Security Token Offering (STO): Evolution

What is a Security Token Offering (STO)?

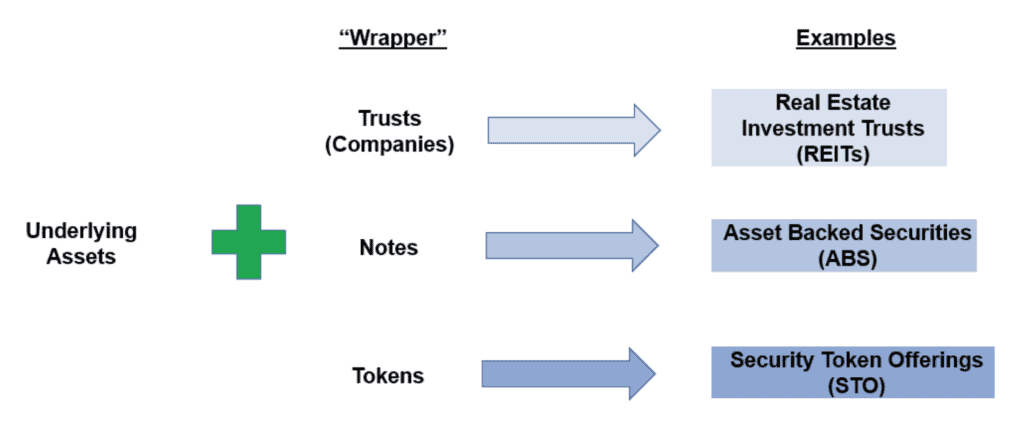

An STO may be viewed as tokens issued using blockchain technology, that are digital representation of rights to underlying assets. As a simplified analogy, the token may be viewed as “wrapper” on the underlying assets, as we witness its evolution similar to other “wrapper” forms previously.

Real Estate Investment Trusts (REITs)

For example, in the 1960s, the U.S. established the Real Estate Investment Trusts (REITs) to allow retail investors access to the various real estate investments, which were previously available only to large financial intermediaries and wealthy individuals, due to their very high investment amounts. Trusts (companies) were set up as “wrapper” around real estate properties. These REITs could then be listed and traded on stock exchanges.

Asset Backed Securities (ABS)

Subsequently in the 1980s, the market issued Asset Backed Securities (ABS), whereby Notes were issued as “wrapper”, that were backed by underlying assets such as home loans, student loans, auto loans, credit card receivables, etc. These Notes could then be traded on the secondary market.

Security Token Offering (STO)

Fast forward to the recent period, tokens (from STO) are issued as “wrapper” on underlying assets, and these tokenised assets can be listed and traded on Digital Asset Exchanges.

STO: Underlying Assets

One of the advantages of STO is the flexibility in tokenising a wide spectrum of underlying assets:

- Companies shares and debts: Mortgages, project financing;

- Investments funds: Traditional mutual funds, hedge funds, crypto-strategy funds;

- Physical assets: Real estate, certain floors/space within properties;

- Luxury assets: Watches, art, precious stones;

- Cashflows: From properties such as rentals, projects.

STO: Advantages

In addition to the advantage mentioned in the section above, some of the other advantages of STO include (not exhaustive):

- Fractionality: High investment amount assets can be fractionalised and owned by a wider pool of investors;

- Speed: Origination, issuance and listing of STO may be done at a shorter time period than other traditional investments;

- Costs: Origination, issuance and listing of STO may be done at much lower costs than other traditional investments.

STO: Generic Process for Tokenised Assets

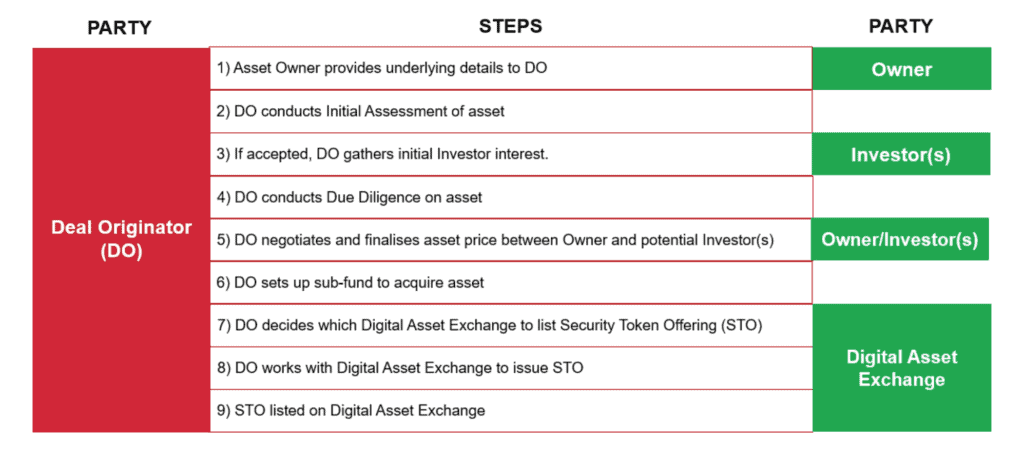

A summary of a simple, generic process for STO, from deal origination to its eventual listing on a Digital Asset Exchange may be represented as follows:

As shown by the above diagram, the STO steps are similar to Initial Public Offering (IPO) in shares, except for two main differences: the issuance of tokens (instead of shares), and the trading platform on Digital Asset Exchange (instead of stock exchange).

Conclusion

With the continuing development in blockchain technology and Web3 (World Wide Web based on blockchain technology), which incorporates concepts such as decentralisation and token-based economics, there is no doubt that STO as an asset class will advance further, including but not limited to, other ancillary products linked to it, e.g. lending, staking of these tokens, etc.

Stay tuned to this exciting space!