Crafting and delivering a sustainability-led, ESG-focus vision is not just about checking the boxes or a seductive marketing campaign. It is about thinking long term and taking a long view. That vision must be operationalized and road-mapped so that the company achieves profitable growth (economic sustainability), has adequate cash flow and able to care for the common good. This can indeed be a herculean task in these pandemic times or in the new normal.

Short-termism, the short-term approach to business and investment is the nemesis of long-term vision and has been called out for hampering ESG investing: the environmental, social and governance strategy, which, studies say1, drives stronger long-term returns. In 2020, Morningstar found that funds with higher ESG ratings outperformed their benchmark indices more frequently than those exposed to greater ESG risk. Similarly in 2017 the McKinsey Global Institute found that companies which took a long-term approach had 47% stronger cumulative revenue growth, with less volatility, than other groups. Yet 70% of executives surveyed by McKinsey last year believed that their CEOs would sacrifice long-term growth for short-term financial objectives. This disconnect is what companies need to address to bridge two critical gaps:

“The knowing – doing gap”

Similar to the McKinsey study, an earlier study by BCG/MIT finds that whereas 90% of executives find sustainability to be important, only 60% of companies incorporate sustainability in their strategy, and merely 25% have sustainability incorporated in their business model.

“The compliance – competitive advantage gap”

More companies are seeing sustainability as an area of competitive advantage, but it is only a mere 24% (as reported in the BCG/MIT study). Since all companies need to be compliant, these topics must be tackled separately and not in a one sweep. Compliance is holistic, a “must do”. For competitive advantage, only a few material issues count.

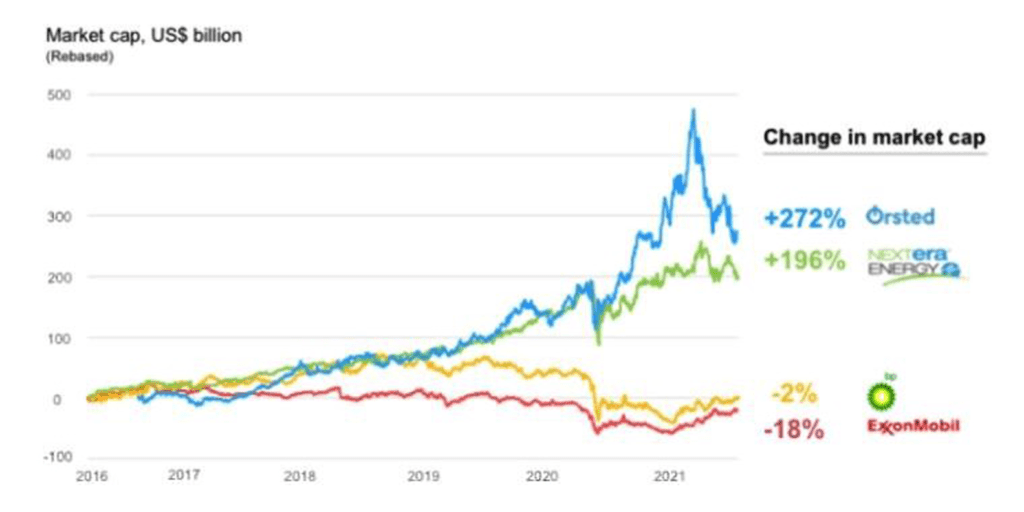

The diagram below tracks the fortunes of Orsted and NextEra Energy Vs the supermajors in the Oil and Gas industry explicitly driving home the transformative value of a sustainability-led strategy.

Change of Guards in the Energy Industry

Ørsted, formerly DONG, Denmark Oil and Gas Energy, is a state-run business which is consistently ranked as the most sustainable company in the world. Ask any Dane and they will proudly share how Orsted and the Danish Government are aligned on one long-term goal: to become the world’s green energy supermajor. This would have sounded like misguided bravado when Orsted embarked on their brown to green journey in late 2000s. The transformation from a predominately coal- and natural-gas dominated utilities to a pure-play green energy company focused on wind technologies gathered momentum with stakeholders. It is often said that Ørsted has impeccable timing as its transformation fits in well with climate change rising up the political agenda, investors increasingly seeking less polluting options and the company having the right strategic options and ecosystem. But there’s more in why ESG funds are betting on them – it is definitely not based on what Ørsted said they will do in 2008 or 2021 but for what the long-term growth prospects might be and the convictions their leadership hold.

The climate (sorry the pun) is definitely conducive for all the four companies profiled to have a compelling sustainability-focused long-term vision that is aligned with the Paris Agreement and COP 26 goals. Equally, a well thought out business case can be put together and you can kick off strategic dialogues with your leadership team with the Sustainability-focused OGSIM toolkit provided here.2

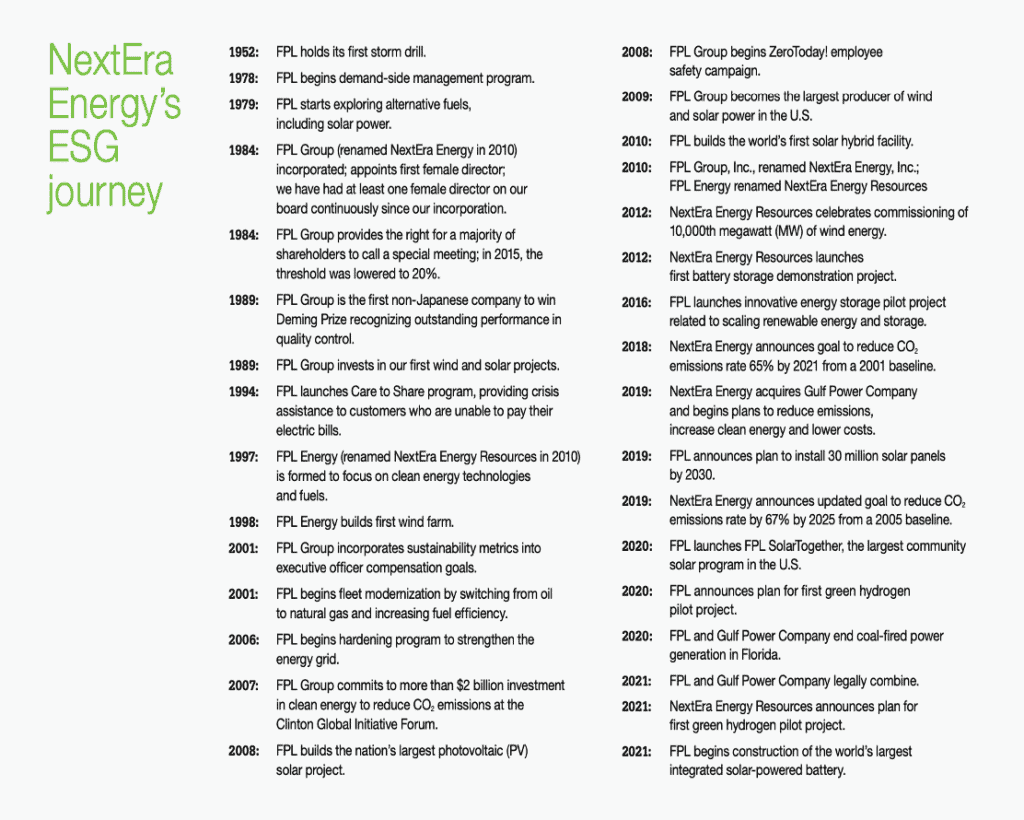

Sustainability is not just a European story, as many critics would allude to the sustainability policy agenda has been the continent’s top priority since 2015. We reviewed the strategies of three other companies that are laser-focused on the green economy. US-based NextEra Energy (formerly FPLEnergy) pivoted to clean energy technologies and fuels business in 1997 when renewables were hardly fashionable, but they believed in their vision. NextEra’s ESG roadmap detailed below speaks for itself.

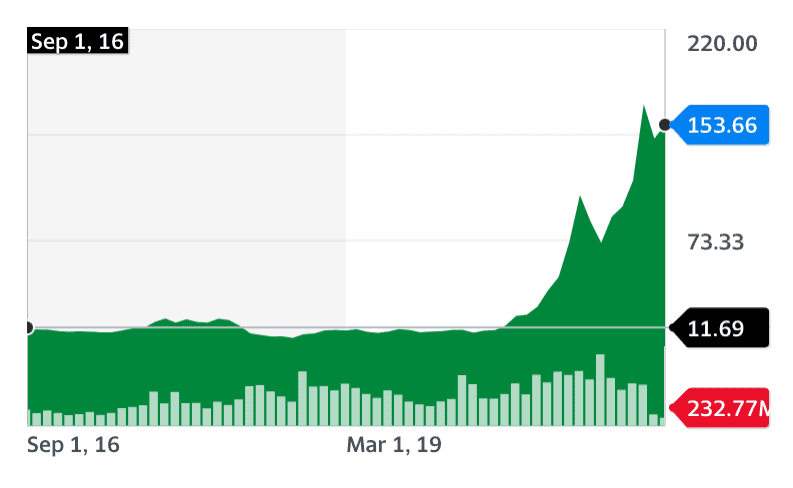

Sungrow of China is another phenomenal story of having a long-term vision to be the biggest solar inverters manufacturer in the world. Founded in 1997 by a university professor, Cao Renxian, Sungrow has a broad product portfolio PV inverter solutions and energy storage systems for utility-scale, commercial and residential applications as well as internationally recognized floating PV plants solutions in 150 countries. For Sungrow, it has never been business as usual, innovated their way to be the global leader for solar inverters with a 20% market share. The company has seen strong growth in the US (where it has around 30% market share) and the EU. Its goal is to increase its long-term solar inverter market share to 30% globally and expand more capacity globally. It is also an early mover in energy storage systems (ESS) and has set its sights on scaling further by collaborating with leading lithium battery manufacturers.

Diagram: Sungrow’s stock performance on the Shenzhen Stock Exchange (retrieved from Yahoo Finance on 3 Aug 2021)

Singapore’s first large-scale floating solar photovoltaic (PV) system was recently commissioned by Prime Minister Lee Hsien Loong. At 45 hectares, about the size of 45 football fields, it is one of the largest in the world. Its developer, SembCorp is in a good position to capitalize on the megatrends of decarbonisation, urbanisation and electrification that are re-shaping the world. Sembcorp is “driven by a clear purpose to play our part in building a sustainable future. With our strategy fully anchored in this purpose, sustainability is front and centre of all that we do”. Their vision is to be “a leading provider of sustainable solutions. We aim to transform our portfolio from brown to green, by focusing on growing our renewables and integrated urban solutions businesses. To support the global energy transition and sustainable development, we target to grow Group net profit contribution from sustainable solutions to 70% by 2025”. Again, vision is matched by strategic clarity and SMART targets.

These four examples of enlightened green energy companies from around the world should provide the impetus to integrate sustainability into your business strategy as a long-term endeavor.

In conclusion, we can draw inspiration from Jeff Bezos of Amazon whose first shareholder letter in 1997 was aptly entitled “It’s All about the Long Term.” Bezos boldly declared then that Amazon “will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions”.3 Indeed, as corporate leaders we must acknowledge that no matter which industry or country we operate in, a sustainability-focused long-term vision supported by a robust business strategies will resonate well with stakeholders and investors at this current time.

Footnotes:

[1] In 2020, for example, the CFA Institute, the association for investment management professionals, estimated the cost of short-termism to S&P 500 companies at $79bn a year in forgone earnings. See also https://on.ft.com/3bAnK8M

[2] Please access the toolkit at https://www.rhtgreen.com/sustainability-mission-to-strategic-implementation-toolkit/ or speak to one of the RHT Green consultants if you wish to have a more in-depth discussion.

[3] https://s2.q4cdn.com/299287126/files/doc_financials/2021/ar/Amazon-2020-Shareholder-Letter-and-1997-Shareholder-Letter.pdf (accessed 3 August 2021)